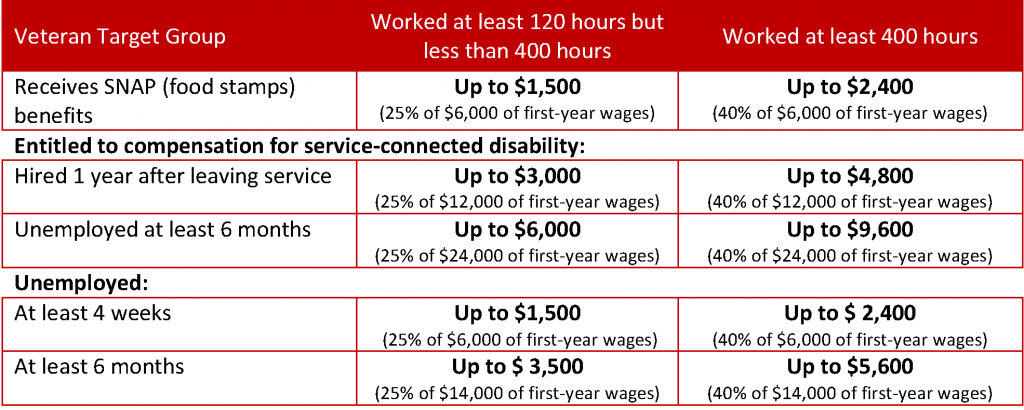

Hiring a United States Veteran can potentially make you eligible for a tax credit of up to $9,600. To qualify for a WOTC credit under the Veteran target group, the individual must first complete the 8850, and 9061 forms. If an individual identifies themselves as a veteran, our online system will ask for a copy of the veteran’s DD214 Discharge form. Forms must be submitted to the State Workforce Agency within 28 days of the hire date. (Related: WOTC Questions: Do you know how many veterans are hired each year with the assistance of the WOTC?)

Veterans Target Groups

A new hire qualifies for a veterans target group, if the individual is:

- A veteran who is a member of a family that received SNAP benefits (food stamps) for at least a 3-month period during the 15-month period ending on the hiring date;

OR

- A disabled veteran entitled to compensation for a service-connected disability, who has been:

- Hired within 1 year of discharge or release from active duty, OR

- Unemployed for at least 6 months in the year ending on the hiring date;

OR

- A veteran who has been unemployed for:

- At least 4 weeks in the year ending on the hiring date; OR

- At least 6 months in the year ending on the hiring date.

Please note that to have veteran’s status to be eligible for WOTC, an individual must:

- Have served on active duty (not including training) in the U.S. Armed Forces for more than 180 days, OR have been discharged or released from active duty for a service-connected disability; AND

- Not have a period of active duty (not including training) of more than 90 days that ended during the 60-day period ending on the hiring date.

The State Workforce Agency will issue certifications if the individual qualifies.

Earn Real Tax Savings for Hiring Veterans

Where to Post Jobs to Attract Veterans

There are lots of veteran specific job boards that you can post your jobs to to help attract more veterans to your organization. We’ve listed nine of the most popular veteran job boards here.

![]()

iRecruit customers with a Monster.com account can also post directly to Veteran job boards using their Monster inventory.

How WOTC works with iRecruit and iConnect

iRecruit and iConnect is a system that can practically pay for itself through the addition of these valuable tax credits. You can link your iRecruit and WOTC accounts easily. You can use iRecrut’s email templates to request that new hires complete the WOTC Survey online, via multi-lingual call center, or by paper. iConnect customers can include WOTC as part of all of their new hire documents.

iRecruit customers who would like to use WOTC can request the addition of WOTC through your account representative.

For more information about WOTC, or if you have questions about using iRecruit with the Work Opportunity Tax Credit, please contact us below: